Executive Summary (TL;DR)

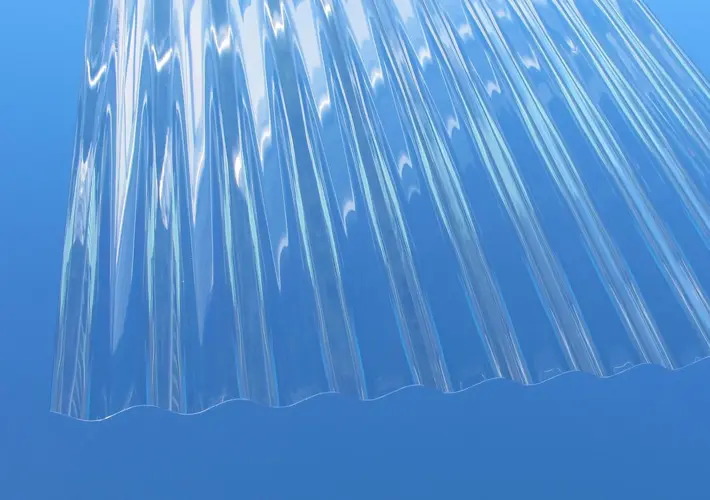

From 2020 to 2025, FRP (Fiberglass Reinforced Plastic) roofing sheets have experienced a “V-shaped recovery followed by stepwise fluctuations” in pricing:

- 2020: Pandemic disruptions, moderate resin and fiberglass costs, and relatively low freight rates kept prices at the bottom.

- 2021–2022: UPR resin and fiberglass price hikes plus extreme surges in global freight rates pushed FRP sheet prices sharply higher.

- 2023: With freight rates falling back and resin supply easing, prices returned to rational levels.

- 2024–2025: The Red Sea crisis and global rerouting increased shipping costs and delivery times. Prices did not reach the 2021 peak but stayed elevated with structural increases for premium grades and peak-season orders.

Typical FOB China Price Ranges (1.2–2.5 mm, UV/gelcoat standard grades):

- 2020: US$1.6–2.2/m²

- 2021: US$2.2–3.2/m²

- 2022: US$2.6–3.8/m²

- 2023: US$2.0–3.0/m²

- 2024: US$2.2–3.2/m²

- 2025 (YTD): US$2.3–3.4/m², premium grades up to US$4.5/m².

What Drives FRP Roofing Sheet Prices?

2.1 Raw Material Breakdown

- Matrix resin: Unsaturated polyester resin (UPR) with styrene monomer.

- Reinforcement: E-glass chopped strand mat / roving fabrics.

- Surface layer: UV protective film or gelcoat (improves weather resistance).

- Additives: Fillers like ATH (flame retardant), curing agents, pigments.

2.2 Cost Structure (Typical Continuous Forming FRP Sheet)

- UPR resin + styrene: 35–55%

- Fiberglass: 25–35%

- Gelcoat/UV film: 8–15%

- Fillers & additives: 5–10%

- Manufacturing, energy & labor: 10–20%

- Packaging & logistics: highly variable.

2.3 External Price Drivers

- UPR resin: Strongly influenced by styrene and petrochemical cycles.

- Fiberglass: Tight supply in 2021–2022 pushed prices upward; stabilized in 2023.

- Global freight: Peaked in 2021 (>$10,000/FEU), eased in 2023, then rose again due to Red Sea rerouting in 2024–2025.

Year-by-Year Price Review (2020–2025)

2020 – Low base

FOB: US$1.6–2.2/m². Stable resin and fiberglass costs; pandemic suppressed demand.

2021 – Resin & freight surge

FOB: US$2.2–3.2/m². UPR and fiberglass shortages plus record-high freight rates.

2022 – High plateau

FOB: US$2.6–3.8/m². Resin and fiberglass still strong; peak orders touched $4+.

2023 – Rational correction

FOB: US$2.0–3.0/m². Freight collapsed, materials softened.

2024 – Red Sea crisis impact

FOB: US$2.2–3.2/m². CIF costs jumped due to rerouting, insurance, and delays.

2025 (YTD) – Structural fluctuations

FOB: US$2.3–3.4/m²; premium/customized products up to US$4.5/m².

Key Specification & Cost Factors

Thickness: Each +0.5 mm raises cost significantly.

Gelcoat/UV film: Adds 8–20% but doubles lifespan in outdoor use.

Flame retardant & chemical resistance: Increases cost by 8–25%.

Color & light transmission: High clarity formulations cost more.

Packaging & warranty: Extra protection and longer warranties reflect in price.

Order structure: Small/urgent orders carry premium prices.

Regional & Trade Term Impacts

- CIF costs rise sharply in volatile freight markets; Red Sea rerouting has added 20–40% to landed costs in 2024–2025.

- Customs & compliance: EU, Middle East, and Latin America may require flame-retardant or anti-UV upgrades.

- Container utilization: Large-size FRP sheets may reduce loading efficiency, increasing per-unit logistics cost.

Procurement Tips for Importers & Distributors

- Specify requirements clearly (thickness tolerance, UV film, gelcoat type, flame-retardant level).

- Separate FOB vs CIF pricing to manage freight risks.

- Use hedging & batch orders to balance raw material volatility.

- Evaluate lifecycle cost (TCO) – higher upfront cost for premium gelcoat often pays back in durability.

- Set measurable acceptance criteria: aging, light transmission, yellowing index, impact resistance.

- Consider premium alternatives (vinyl ester gelcoat, anti-bacterial layers for clean environments).

Conclusion

The five-year FRP roofing sheet price history reflects the intersection of petrochemical cycles, fiberglass supply, and global freight volatility.

As of 2025, prices remain stable but sensitive to logistics and raw material fluctuations.

Importers and distributors should focus on parameter-based quotes, use freight-linked price clauses, and adopt lifecycle cost thinking to manage uncertainty while ensuring long-term competitiveness.