Introduction

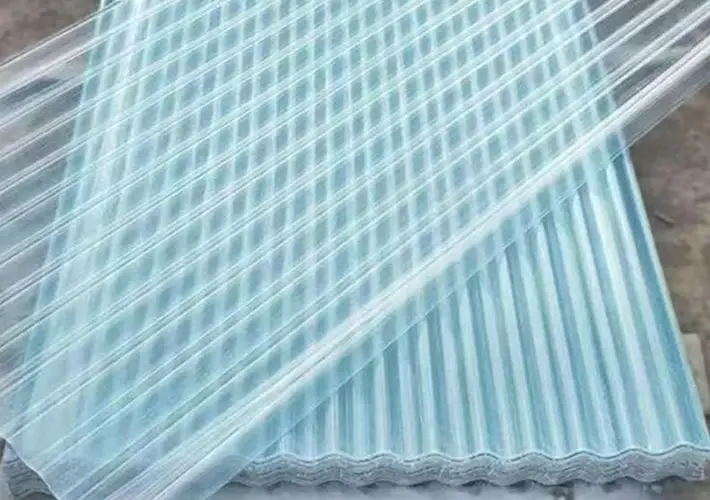

FRP (Fiberglass Reinforced Plastic) sheets have long been favored in construction, automotive, marine, and industrial applications due to their excellent strength-to-weight ratio, corrosion resistance, and ease of installation. In the last five years, the price of FRP sheets has experienced significant fluctuations, driven by changes in raw material costs, global supply chain disruptions, environmental regulations, and market demand.

Understanding the historical price trends of FRP sheets not only helps importers, distributors, and manufacturers plan procurement strategies but also provides insights into market cycles and investment risks.

Global FRP Sheet Market Overview (2020–2024)

The global FRP sheet market has been on an upward trajectory, both in terms of production volume and total market value. According to industry data:

- 2020: Estimated global FRP sheet market value was around USD 3.8 billion.

- 2024: The market is projected to reach USD 5.2 billion, with a compound annual growth rate (CAGR) of 8.2%.

This growth has been accompanied by significant shifts in pricing, especially during the pandemic years and post-pandemic recovery.

Year-by-Year Price Analysis

2020: Pandemic Disruption and Initial Spike

In 2020, the global COVID-19 pandemic severely disrupted the supply chain of raw materials such as glass fiber, unsaturated polyester resin, and epoxy resin—the primary components of FRP sheets. Factory shutdowns in China, Europe, and the US led to raw material shortages, causing prices to surge in the second half of the year.

- Average FRP sheet price: $1.40–$1.80 per square meter (standard type, 2–3mm thickness)

- Price increase: 10–15% year-on-year

- Key driver: Supply chain disruption + shipping cost surge

2021: Record Highs Driven by Logistics Crisis

By 2021, the global logistics crisis intensified, with container shortages and rising freight rates driving the landed cost of FRP sheets even higher.

- Average price: $1.80–$2.40/m²

- Price increase: 20–30% YoY

- Freight contribution: Up to 35% of total landed cost

- Additional driver: Sharp rise in resin prices (epoxy and polyester)

The shortage of containers from Asia to Europe and the US caused delays and overstocking, impacting distributor pricing strategies.

2022: Stabilization and Correction

In 2022, the market saw a brief stabilization in raw material prices. However, energy prices in Europe due to geopolitical tensions (notably the Russia-Ukraine conflict) kept production costs high.

- Average price: $1.70–$2.10/m²

- Price change: -5% to -10% correction in some markets

- Key trends: Energy cost inflation, but partial supply chain normalization

Buyers began diversifying suppliers, especially turning to Southeast Asia and China, where prices were more competitive and production had resumed normal capacity.

2023: Recovery and Rebalancing

2023 marked a recovery year. Demand from construction, automotive, and industrial sectors surged due to delayed infrastructure projects resuming.

- Average price: $1.90–$2.30/m²

- Price change: 8–15% increase

- Key factor: Rebound in demand from US and European construction sectors

- Resin costs: Stabilized, but glass fiber saw marginal increases due to rising sand and energy prices

2024 (to date): Gradual Decline Amid Overcapacity

By mid-2024, global FRP sheet production has entered a stage of mild overcapacity, especially in China and India. Increased supply, combined with softening demand in Europe due to economic tightening, has led to slight price reductions.

- Average price: $1.60–$2.10/m²

- Trend: Downward pressure due to supply surplus

- Forecast: Prices expected to remain relatively stable or decline slightly unless major geopolitical or environmental events intervene.

Key Factors Influencing FRP Sheet Price Trends

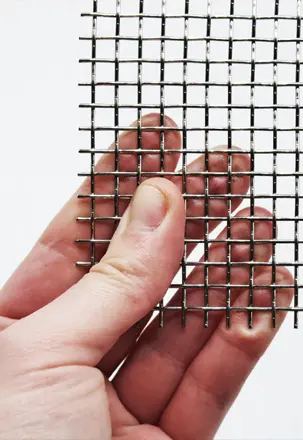

1.Raw Material Costs

- Glass Fiber: Price fluctuations depend on the cost of silica sand, energy, and labor.

- Resins (Polyester, Epoxy, Vinyl Ester): Strongly impacted by petroleum prices.

- Additives & Fillers: Price increases due to higher environmental and safety standards.

Example: From 2020 to 2021, epoxy resin prices rose by over 50%, significantly impacting final product costs.

2.Global Shipping & Logistics

- Freight cost from China to Europe/US jumped from $2,000 to over $15,000 per 40-foot container at peak in late 2021.

- Logistics bottlenecks added 10–25% to product pricing.

3.Labor and Energy Costs

Especially in Europe and the US, energy crises and labor shortages have driven up factory costs, leading many buyers to shift toward Asian suppliers.

4.Environmental Regulations

Stricter environmental regulations regarding resin production and VOC emissions (volatile organic compounds) in Europe have increased compliance costs.

- FRP manufacturers need to invest in cleaner production equipment and waste management, indirectly raising product prices.

5.Market Demand

Sectors that heavily influence FRP sheet demand:

- Construction (roofing, wall panels, floor panels)

- Transportation (buses, trains)

- Marine (boat interiors)

- Industrial corrosion resistance

A temporary slump in the automotive and construction sectors in 2022 slowed down demand and softened prices.

Regional Price Trends Comparison

| Region | Average Price (2024) | Major Driver |

|---|---|---|

| China | $1.50–$1.90/m² | Overcapacity, competitive pricing |

| Southeast Asia | $1.60–$2.00/m² | Rising local demand, low cost base |

| Europe | $2.30–$3.00/m² | Energy + labor costs, green rules |

| USA | $2.50–$3.20/m² | Domestic production costs |

| Middle East | $2.00–$2.60/m² | Infrastructure boom |

FRP Sheet Market Forecast (2025–2028)

Looking forward, experts predict a moderate increase in FRP sheet prices, with regional variations depending on energy, resin prices, and shipping.

Key predictions:

- 2025–2026: Stabilization, average prices between $1.80–$2.20/m²

- 2027–2028: Potential increase due to green resin adoption and carbon emission policies, pushing average prices to $2.30–$2.60/m²

Green trend impact: With demand for eco-friendly FRP sheets rising (e.g., bio-resin-based sheets), prices may increase due to higher production costs.

Recommendations for B2B Buyers

- Secure Long-Term Contracts with suppliers to lock in lower prices during surplus periods.

- Diversify Supply Sources between China, Southeast Asia, and India to mitigate regional risks.

- Monitor Resin Markets, especially for polyester and epoxy fluctuations linked to oil prices.

- Watch Environmental Policy Trends that could impact pricing through regulatory costs.

- Plan Inventory Smartly — overstocking during price drops may yield better margins later.

Conclusion

Over the past five years, FRP sheet prices have been shaped by a complex interplay of pandemic disruptions, shipping crises, raw material volatility, and shifting global demand. While prices peaked between 2021 and 2023, 2024 has seen signs of correction.

For B2B buyers, understanding these trends enables smarter sourcing strategies, better cost control, and stronger supplier relationships. As the market moves toward greener materials and global demand rises, the FRP sheet sector remains both dynamic and full of opportunities.