Market Overview and Size Forecast 📈

1.1 Global and North American Market Landscape

Stone-coated metal roofing is a hybrid roofing material that combines the durability of metal panels with the aesthetics of traditional shingles by coating metal sheets with stone granules.

According to IndustryARC, the global market for this segment was valued at nearly USD 1.3 billion in 2023 and is expected to reach USD 1.9 billion by 2030. North America, especially the US, accounts for over 35% of global demand.

Mordor Intelligence reports that the residential sector contributes over 70% of total market revenues, with rapid growth in states like Florida and California.

1.2 Future Growth Trends

From 2023 to 2030, the compound annual growth rate (CAGR) is projected at approximately 9%.

North America’s CAGR is expected to remain around 6–9%, slightly lower than the Asia-Pacific region but with a larger market base.

By 2030, the global market is forecast to reach over USD 2.1 billion.

Driving Factors

2.1 Sustainability and Environmental Awareness

Stone-coated roofing uses recyclable steel, making it more eco-friendly. Unlike asphalt shingles, which generate over 11 million tons of waste annually, stone-coated tiles can be recycled after their service life.

With the growing enforcement of LEED and IECC 2030 green building standards, stone-coated roofing aligns with the US market’s shift toward sustainable materials.

2.2 Climate Resilience and Disaster Protection

The US frequently experiences natural disasters such as hurricanes, floods, hailstorms, and wildfires. In 2023 alone, there were 28 climate disasters exceeding USD 1 billion in damages.

Stone-coated tiles are Class A fire-rated, highly wind-resistant (up to 130 mph), and hail-impact resistant, making them suitable for regions like Florida and California.

2.3 Aesthetic Versatility

These tiles can mimic clay tiles, wooden shakes, or slate, offering diverse design options that suit Mediterranean, Spanish, or modern American home styles.

Their combination of beauty and durability also makes them a favorite among homeowners. Some insurance providers offer 5–15% premium discounts for impact-resistant roofs.

2.4 Cost Efficiency Over the Long Term

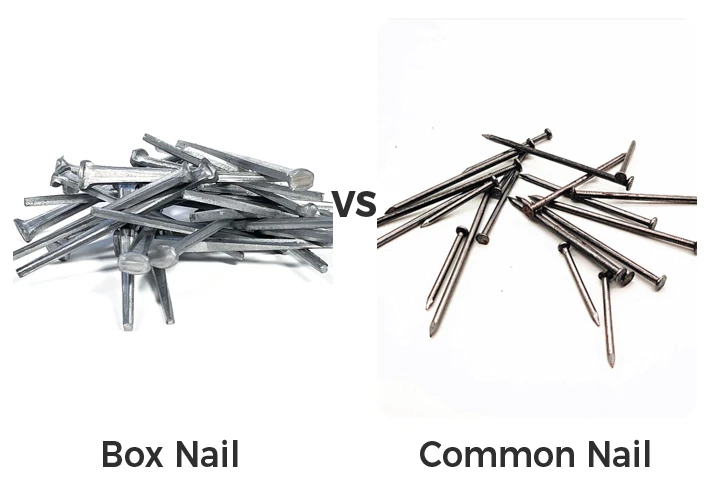

Although the initial cost is 8–12% higher than asphalt shingles, stone-coated roofs last up to 50 years (compared to 15–20 years for asphalt), making them more economical in the long run.

With innovations in manufacturing and economies of scale, unit costs are expected to continue declining, enhancing market adoption.

Challenges and Solutions

3.1 High Initial Investment

Stone-coated roofs typically cost 30% more upfront than traditional options.

Solution: Emphasize total cost of ownership (TCO), insurance discounts, energy savings, and longevity. Promote DIY-friendly designs and professional training to reduce labor costs.

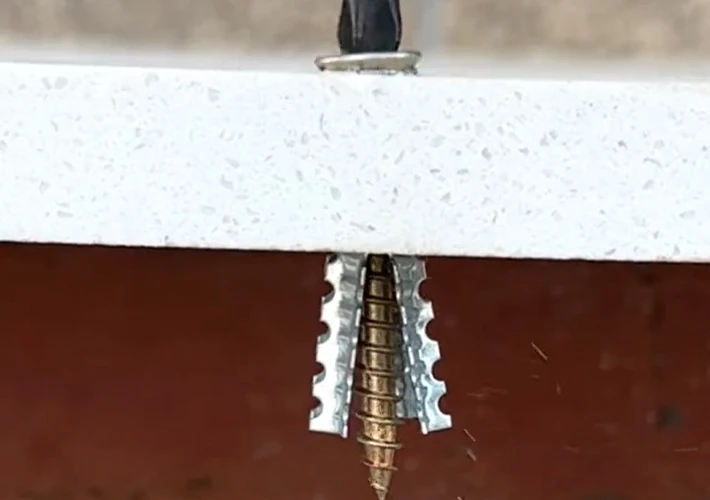

3.2 Installation and Maintenance Barriers

Improper installation can lead to water leakage or wind uplift. Maintenance, such as replacing individual panels, may require removing adjacent pieces.

Solution: Design pre-assembled modules, leave inspection panels, and offer certified installer training programs.

3.3 Hail Dents and Insurance Disputes

Hailstorms may cause cosmetic dents that don’t impair functionality but are excluded from most insurance policies.

Solution: Develop hail-resistant coatings and promote insurance products that cover cosmetic damages, ideally through brand-insurance partnerships.

Competitive Landscape and Brand Opportunities

4.1 Key Players

Major brands in the US include Boral Roofing, DECRA, Gerard, Bjorkstrand, Fabral, Roser, and Tilcor.

Competition is based on product aesthetics, fire/hail/wind resistance certifications, and green building compliance.

4.2 Market Fragmentation and Concentration

The US market is relatively consolidated, while global production includes many OEM manufacturers.

Opportunities exist for consolidation and for Chinese manufacturers to enter the US market through mid-range product positioning.

4.3 OEM and Import Potential

Brands like Tilcor from New Zealand have established export pipelines to the US. Chinese OEM manufacturers can serve as competitive price alternatives for budget-conscious consumers.

Technological Innovation Trends

5.1 Improved Coating Techniques

New coatings offer better UV resistance and long-lasting color (up to 30 years). Powder-bonded and thermoset granules increase performance.

5.2 Functional Add-ons

ENERGY STAR-rated “cool roof” coatings reflect sunlight, reducing cooling energy usage by 18–22%.

Some brands have developed solar-ready panels with hidden fasteners or embedded solar connectors.

5.3 Modular Panel Design

Interlocking modular tiles improve installation speed, geometric accuracy, and enable custom architectural patterns.

Policy, Regulation, and Insurance

6.1 Regional Building Codes

States like California and Florida have strict fire and wind resistance standards. Class A fire-rated stone-coated roofs meet these requirements.

LEED and IECC guidelines favor recyclable and high-reflectivity materials, which aligns with stone-coated tiles.

6.2 Insurance Implications

Many insurers offer premium discounts for impact-resistant and fire-rated roofs. However, cosmetic hail damage is often excluded from coverage.

Suggestion: Collaborate with insurance providers to establish new underwriting rules that include cosmetic damage coverage for approved products.

Regional Market Analysis

7.1 US Regional Demand

- Florida & Gulf States: Hurricane resistance is a major selling point.

- California: Fireproof and aesthetic roofing is in high demand.

- Midwest: Hail resistance is key; demand rising in Ohio, Illinois, and Colorado.

- Texas: Large residential base and extreme weather events make it a key growth state.

7.2 Climate-Specific Considerations

- In snow-prone regions, stone-coated roofs reduce ice dam risks and facilitate snow shedding.

- In seismic zones like California, their light weight (~150 lbs/sq) compared to clay tiles (~850 lbs/sq) provides structural safety advantages.

Strategic Recommendations

8.1 Enhance Consumer Awareness

Provide comparative data and visuals showing performance vs. asphalt shingles. Highlight wind/fire/hail resistance through real-world tests and videos.

8.2 Strengthen Distribution and Installation

Partner with architects and contractors to specify products at the design stage.

Build a network of certified installers and offer post-sale support, including warranty services.

8.3 Expand OEM & Custom Capabilities

Offer tailored products for local climate demands and aesthetic preferences.

Enhance surface treatments for better hail resistance and anti-aging performance.

8.4 Integrate Technology

Develop solar-ready designs, smart coatings, or AI-based inspection tools to enhance performance and maintenance.

Conclusion: Long-Term Prospects

The US market for stone-coated roof tiles is expected to grow steadily, driven by:

- Increasing climate extremes and disaster frequency;

- Sustainability and green building policies;

- Homeowner awareness of long-term savings;

- Aesthetic and architectural diversity;

- Policy and insurance reforms.

With proper product positioning, improved installer networks, and continuous technical innovation, stone-coated roof tiles could capture 10–15% of the US roofing market by 2030 and become a mainstream choice for both new builds and renovations.